MONDAY 28TH OCTOBER 2013

Offers new tools for diversification. Offers new indexes that automatically diversify across all the currencies, just like someone who wishes to buy stocks can buy Nasdaq, the S&P 500, and other indices. So we are developing indices for the Bitcoin and cryptocurrency space – Ron Gross

MONDAY 9TH DECEMBER 2013

Peter Schiff: It’s Not a Limited Supply of 21 Million

There could be a lot of value in Bitcoin’s payment system. But if it’s not proprietary, if it’s not protected by patents, if there could be hundreds or thousands of competing identical coins that are circulating around, then the potential supply of digital currency is not 21 million, it’s unlimited.

If all Bitcoin has is that it was first, I don’t know if Bitcoin is My Space or is it Facebook, or is there something else that’s going to out Facebook Facebook? I don’t even know that people are going to be using Facebook in 10 years. We don’t know – Peter Schiff

MONDAY 9TH DECEMBER 2013

An Unlimited Supply of Crypto-Currency Units

Bitcoin cannot really be copied. True, the open-source code can be copied and the copier could release CopyCoin (indeed this is happening all the time). But, the copier cannot copy the infrastructure. The protocol layer is easily copied. The infrastructure layer is not.

On Day 1 of Bitcoin, it had no infrastructure layer. I can tell you, as an entrepreneur in this space for the past few years, Bitcoin’s infrastructure layer is now substantial. Indeed, I am sitting in my office, and looking at my employees building this very infrastructure as I write this. Their work, and that of many thousands of others around the world, is not so easily replicated – Erik Voorhees

MONDAY 16TH DECEMBER 2013

How does one differentiate between the 40 odd coins out there?

Easy: ignore 39 of them. Pay attention to the one with $10bn monetary base. Transaction volume for almost all the alt-coins is zero. Only one being used in commerce – Andreas Antonopoulos

MONDAY 16TH DECEMBER 2013

The idea that a bank-alt-coin could displace bitcoin is laughable. It fundamentally misunderstands scale, innovation & de-centralization. Let banks and govts make alt-coins. “Innovation at the edge” in a de-centralized network will always win. ATM/SONNET vs. TCP/IP – Andreas Antonopoulos

MONDAY 6TH JANUARY 2014

Though a joke, coingen.io is actually one of the most important milestones in recent history. Anyone can now start a currency. Balaji S. Srinivasan

Alt-coin generator http://coingen.io/ is great. It should help make it obvious that non-technically-differentiated alts are worthless – Robustus

MONDAY 13TH JANUARY 2014

Zynga’s Impact on Alt-Coins

BTC is out of reach of kids, but they can mine primecoin or dogecoin and trade up since there’s no minimum age req! #wow

Kids can mine their own coins to pay for their gaming habits. It will grow virally – Bryce Weiner

MONDAY 13TH JANUARY 2014

Monetary Experiments

I want to see every Econ 101 student implement their own crypto currency, with deflationary or inflationary rules as they choose #bitcoin – Jeff Garzik

Monday 20th january 2014

SHA-256 Altcoins

Keep your eye on SHA-256 altcoins for the next six months. Smaller miners have to go somewhere or sell their equipment. 3Th/s and under is a “small miner” – Bryce Weiner

MONDAY 3RD FEBRUARY 2014

OpenTransactions makes all centralized distribution metacoins look like scams. #truthhurts – Bryce Weiner

MONDAY 24TH FEBRUARY 2014

Money is just a database entry – Jered Kenna

TUESDAY 1ST APRIL 2014

The World’s First Master’s Degree in Digital Currency

Free online course in Digital Currency from the University of Nicosiahttp://digitalcurrency.unic.ac.cy/ #bitcoin #future #finance – Erik Voorhees

Tuesday 27th May 2014

The altcoin market currently has a market cap of $700mill compared to Bitcoin’s $7.3 billion.

Impressed by the size of this market, I set out to find 10 genuinely useful digital currencies to support that might become major players in future commerce and trade.

Disappointingly, it’s difficult just to find 10 altcoins that aren’t blatant premine /instamine/ fastmine pump and dump scams, never mind 10 coins that genuinely improve on bitcoin.

That’s pretty amazing to say, considering these coins have a chance to experiment with the most groundbreaking technology in the fastest growing industry in the world.

Looking at the price charts on coinmarket.com we can see a familiar pattern for most altcoins – A quick pump at launch by a few preminers / instaminers whose massive stake in the currency allows them to easily manipulate the price up, create an impressive market cap and percentage return which sucks in greedy investors through marketing hype, then dump it on them to send the coin crashing by 90% or more. PoW / PoS hybrids are particular notorious for this problem.

Most coins were disqualified from my “ethical / genuinely useful” list for the following reasons:

1 – Launch: Scam distributions leading to short life of the coin because instaminers look to cash out early after an initial pump

Distribution of a new currency is a huge and underrated problem for competing coins. Bitcoin remarkably solved this by taking a patient and meticulous approach to issuing coins in a steady, consistent supply over a long period of time. Satoshi didn’t give himself higher block rewards than the other early miners.

Bitcoin took 10 months to obtain any value at all. Most founders of altcoins reward themselves with a massive percentage of the money supply within the first few days and have a coin worth millions within 10 days.

The problem of a “fair” distribution where the coin isn’t susceptible to early investors purposefully cashing out is a huge problem.

Current large coins that are particularly bad offenders of this are:

Peercoin 3rd biggest in the world

Blackcoin, 10th biggest in the world

Megacoin 21st biggest in the world

2 – Snake Oil Cryptography Claims: A New Hashing Algorithm

Coins claim to have superior security and a unique selling point to bitcoin by using different algorithms.

This is an attempt to blindly impress with cryptographic jargon to create the illusion of a significant feature over bitcoin, when really none exists.

Security expert Bruce Schneier breaks it down in this post

3 – Lack of Understanding of the Economics of Bitcoin – Why a Hard Limit Resulting in Deflation Is Important to the World, Importance of Decentralization, Etc…

This rules out currencies such as Dogecoin, Freicoin, Ripple

Tuesday 27th May 2014

“Don’t let speculative experiments at the margin distract from the most mind-blowingly awesome monetary system mankind has ever seen – Bitcoin proper” – Erik Voorhees

The altcoin market is a shambles. “Speculative experiments” is an overly generous description of almost all altcoins.

What is claimed to be “experimentation” or “next generation” is mostly a lying fraudulent mess of worthless get rich quick schemes. This is unfortunate, as the stakes for creating a genuinely successful digital currency couldn’t be higher. Bitcoin is currently the market leader, but hasn’t won yet so you would think it would be all to play for.

This is not the case. Founders who have a decent name, brand, logo (blackcoin) or a seemingly decent feature (darkcoin) could not resist the temptation to cash in on a quick instamine pump and dump over a couple of months, rather than build a coin up that aims for real merchant adoption over a period of many years.

Bitcoin is a remarkable experiment. Despite having 5 years to create a better model, most competitors have failed to balance the tough problem of allocating a coin in a sustainable way.

Even after 5 years, nothing comes close to bitcoin in integrity and utility. – Lee Banfield

MONDAY 2ND JUNE 2014

Altcoin Speculation

I couldn’t give a shit about all this altcoin speculation stuff. I think it’s all rubbish, including the really unfortunate idea to release ZeroCash as an altcoin – Greg Maxwell

MONDAY 16TH JUNE 2014

Ethical Altcoins

Ethical way to start a coin, the Satoshi way: announce in advance, zero pre-mine or pre-stake. Everybody starts from zero, even founder

The creation of a new digital commodity (coin) to kickstart a company seems risky right now – Jeff Garzik

MONDAY 23RD JUNE 2014

The Dominant Anonymous Coin

My thesis is that LTC slowly bleeds market-cap to whatever the dominant anon-coin ends up being over the course of 1-3yrs – Dan McArdle

Thursday 14th August 2014

Learning from Altcoins

In general, the most interesting alt coins are the ones that fail in a unique and spectacular way that we can learn from. Freicoin is an excellent real-world falsification of the desirability of demurrage –Justus Ranvier

Wednesday 20th August 2014

Alternative Chains, Currencies, and Applications

Chapter 9 “Alternative Currencies” of my book “Mastering Bitcoin” is drafted, now on github: https://github.com/aantonop/bitcoinbook/blob/develop/ch09.asciidoc

Wednesday 20th August 2014

Anonymous Coins

Even if New York somehow succeeding in regulating bitcoin, which I think is extremely unlikely, all they would so is encourage the development of alternatives that are much more stealthy and much more anonymous. These already exist, and at the moment no one feels the need to switch from bitcoin to these alternatives, until of course New York starts getting more and more aggressive with their enforcement actions at which point the people of New York may find it necessary.

We’ve seen this happen before, it was the evolutionary path taken from Napster to BitTorrent.

In retrospect the media recording companies should have made a deal with Napster. Instead what they did was to ignore reality, to ignore the fact that they live in a post scarcity economics environment in terms of music production and distribution and to think that they could continue to extract extravagant profits from CDs.

Their entire industry collapsed in on itself because when they stomped on Napster they got Kazaar and when they stomped on Kazaar they got Limewire and when they stomped on Limewire they kept stomping and eventually they got BitTorrent. And BitTorrent turned around and bit their arse –Andreas Antonopoulos

Antonopoulos talks about a necessary evolution from bitcoin, but we’ve already been through this process to get here. They stomped on centralized digital currencies like Liberty Dollar and Liberty Reserve and eventually they got Bitcoin. Instead of switching to a stealthier altcoin, it’s much easier just to use bitcoin in stealthier ways by using services like Dark Wallet – Lee Banfield

Tuesday 16th September 21014

Bitcoiners Should Think Twice Before Throwing Away Even a Couple Millibits Towards Altcoins

Bitcoin is poised for exponential growth, so the opportunity costs of not being involved to the highest personal degree possible are incalculable.

Yet merchants, investment peddlers, and other hoarders have been able to convince countless bitcoiners to part with their future riches, despite the obvious downsides given you have a long enough time horizon to see the coming post-fiat world. They’ll tell you spending is vital, that Bitcoin 2.0 will be even better if only you give them some of your Bitcoin 0.9, or that your bitcoins are worth only $475 a piece. They’ll tell you this with a straight face, the wringing of their hands unseen across the Internet.

Bitcoin is exciting. Looking at a static wallet file and balance is not. Instead of holding and forgetting, many bitcoiners choose to “put that money to use,” and endless crypto-peddlers are ready to snatch your bitcoins up. They’ll offer you mining contracts, present their plans for a hedge fund, or entice you into investing in a Bitcoin company. Today, the most popular investment vehicle for bitcoiners are Bitcoin 2.0 schemes, ranging from Mastercoin to Ethereum.

Long term investors should use Bitcoin as their unit of account and every single investment should be compared to the expected returns of Bitcoin.

If hyperbitcoinization occurs, Bitcoin holders will see their purchasing power increase by orders of magnitude. Bitcoiners should think twice before throwing away even a couple millibits towards a project “just to see where it goes.” A running joke in the community is how expensive the two pizzas Laszlo bought were. We joke about a million dollar pizza, and hyperbitcoinization has not even occurred yet. I praise Laszlo for his entrepreneurial use of a new technology, but I do not wish for myself or others to be a Laszlo.

My friends and I joke about starving due to the intense deflation, but I can’t say I don’t look back and wish I had skipped a couple lunches in the crappy dorm cafeteria to buy $10 bitcoins when I had the chance. Hyperbitcoinization will not be a force to trifle with. Even a marginal bitcoin holding right now will constitute a very significant majority of a bitcoiner’s portfolio. Once it happens, there is no going back. One day, your Bitcoin balance will likely never see the decimal point move to the right again. – Michael Goldstein

Tuesday 23rd September 2014

Altcoins & Appcoins

When Chris Odom was asked about his thoughts on altcoins and appcoins at Inside Bitcoins London, there were many people in the crowd who were surprised by his answer. While some people like to research every altcoin on the market to see what new features it has to offer, the creator of Open Transactions almost seemed bored with the entire concept.

At first, Odom said nothing more than, “I don’t think that altcoins are going to be that relevant compared to Bitcoin.” There was an awkward pause that lasted for the next few seconds, as the audience wanted him to explain his anti-altcoin position on a panel that was supposed to be all about the future of altcoins. Odom was then asked to go into more detail on his position throughout the rest of the panel, and most of his responses were able to illustrate how Open Transactions makes many altcoins “irrelevant.”

After claiming, “Bitcoin is the winner.”, Odom went on to explain how the coins behind certain decentralized apps in the Bitcoin space don’t really have a reason to exist. The man also known by his online alias FellowTraveler claimed, “[Developers] are creating additional functionality and they’re using these appcoins to fund development, but the actual additional functionality that they’re creating would be perfectly viable without the appcoin itself.

Odom went on to state, “Whenever you make a system that uses an appcoin, there’s going to be some comparable system in the near future that doesn’t have an appcoin that has the same functionality.” –Kyle Torpey

Wednesday 15th October 2014

Competing Block Chains

A centralised data centre is more secure than the second strongest distributed block chain.#zerosumgame – Jon Matonis

Monday 20th October 2014

Why Open Transactions? Because Appcoins Suck

Here’s the endgame as I imagine it:

* Bitcoin is base money. It is used as cash for most types of routine purchases.

* The blockchain also serves a few non-monetary roles, like hosting colored coins.

* OT is a contract-processing system. It is used for financial instruments (everything that is not base money): loans, stocks, bonds, trade credit, smart contracts, all types of credit in general

* In order to achieve federation, OT will rely heavily on colored coins

* Colored coins can’t host their own metadata in the blockchain, so they need some type of external metadata processing system in order to be useful.

* OT will become the standard metedata system for colored coins

* OT + colored coins makes Ripple, Counterparty, Mastercoin, Bitshares, etc all redundant.

* Users will prefer OT+CC to all the above because OT+CC doesn’t require them to purchase tokens from IPO investors.

* Ethereum is impractical for reasons beyond the scope of this post

* Openbazaar-style functionality is already being added to the reference OT GUI

* OT will survive because it has avoided the mandatory token approach, all the other projects will not.

Monday 3rd November 2014

Bitcoin vs. Govcoins

Took even Estonia 20+ yrs after web for e-citizenship. Govs slow; IMO Bitcoin gets huge first before govcoin – Balaji S. Srinivasan

Thursday 1st January 2015

Peak Altcoin Hype

“Don’t let speculative experiments at the margin distract from the most mind-blowingly awesome monetary system mankind has ever seen – Bitcoin proper” – Erik Voorhees, 2013

In 2013 a common line of thinking was that bitcoin’s value would be diluted by copy and paste altcoins (despite obvious evidence to the contrary, Peter Schiff and Warren Buffett still continue to make this claim).

2014 saw hundreds of scam coins and worthless copies come along (Dogecoin and Auroracoin are particularly memorable examples). None have come close to challenging bitcoin as a serious transactional currency with a meaningful network effect.

Litecoin was the 2nd largest digital currency in the world a year ago. Some people even speculated it would grow into a mainstream currency “the silver to bitcoin’s gold” but instead it has weakened and fizzled out. Bitcoin’s market cap is now 45x larger than Litecoin’s, up from just 18x seven months ago.

“Blockchain tech” and “Bitcoin 2.0” have become huge buzzwords. – Lee Banfield

Thursday 5th March 2015

Distractions

Ripple, Stellar, and Altcoins are all a distraction. Bitcoin is way too far ahead. We should be focused on bitcoin and sidechains – Brian Armstrong, Coinbase

Wednesday 18th March 2015

Shapeshift Currency Exchange

Instant bitcoin and altcoin exchange ShapeShift has received $525,000 in seed funding from investors Barry Silbert and Roger Ver.

The Swiss-based platform, which lets users swap between 25 digital currencies and tokens, differs from traditional exchanges in that it operates without user accounts and requires no form of registration.

As part of the funding announcement, entrepreneur Erik Voorhees has come forward as ShapeShift’s creator and CEO, having operated under the alias Beorn Gonthier – a reference to J R R Tolkein’s own shapeshifter – since its launch in 2013.

“I wanted the early launch of ShapeShift to be about the innovation of the site itself and its advancement over traditional order-book exchanges, rather than about me,” he said. According to Voorhees, the $525,000 will go towards improvements to the exchange engine, as well as marketing and legal work in Switzerland, the company’s base.

The company runs entirely on bitcoin, so it has no bank accounts and no fiat passing through its books – Grace Caffyn

What is unfolding is truly remarkable. People are beginning feel the promise of this new technology – Thomas Vaughan

————————

This is consumer protection. And not only is it far safer for users, it is much faster. The marketplace seems to like this model; ShapeShift’s exchange volume has been growing by 30% per month for the past six months. There is no easier or safer way to trade Bitcoin with Litecoin, Darkcoin, Ripple, NXT, Bitshares, and other leading digital assets.

There is no signup process whatsoever. You can now move between digital assets with the grace and elegance that only cryptocurrency permits – Emily, Shapeshift

Monday 13th April 2015

Shapeshift.io

Max Keiser’s featured guest, Erik Voorhees, bitcoin entrepreneur and CEO of ShapeShift.io, weighed in on the role that cryptocurrencies can play in improving the financial system.

Voorhees spent some time explaining ShapeShift.io, which quickly exchanges cryptocurrencies. He described it as a new piece of infrastructure.

“It is how digital currency exchange should work. From start to finish, you can change currencies in under ten seconds, no account required.”

ShapeShift.io holds an inventory of each altcoin / cryptocurrency it exchanges. Voorhees compared it to Travelex, a service at the airport that allows people to exchange different currencies.

Noting that Voorhees was an early skeptic of alternate cyrptocurrencies, Voorhees said he has changed his position.

“I realize a lot of these digital currencies do special things. Some do things bitcoin doesn’t do.”

Any coin that does something useful can find a niche. Those currencies that are clones of each other don’t serve a role. “A lot of these will fail, that is the point of experimentation.”

Wednesday 6th May 2015

Buy on Amazon at Discounted Prices: Purse.io Integrates ShapeShift

Spend Tether, Dash, Litecoin, XRP, Monero, CounterParty, NXT & more at Amazon – Erik Voorhees

Supports the following countries: UK, Canada, Germany, Japan, China, France, Italy, Spain, India –ShapeShift.io

Monday 1st June 2015

Shapeshift.io

I was motivated to start Shapeshift.io because I wanted to buy an altcoin a year ago and it was going to take a couple hours to do so. This is not acceptable. Digital assets should be immediately available & immediately liquid. So I tried to figure out how to make an exchange that didn’t have any of the time delay of a normal one.

Turns out, you don’t need accounts whatsoever to do exchange with cryptocurrency, so that’s what we built. We realized, happily, that ShapeShift was actually the most secure/safest exchange as well, because nobody had to leave funds on deposit. This makes it much safer for users, and vastly reduces liability/risk for ShapeShift – Erik Voorhees

Monday 1st June 2015

The Coinomi Android Wallet

It’s a multicoin wallet, so you can hold a dozen different cryptocurrencies easily on your phone. Beautiful interface as well. Inside the app itself, there is an exchange function, which lets users convert between coins. This is done with the ShapeShift API and is a beautiful thing to see and experience.

We also foresee it being used by anyone who accepts Bitcoin on their site, to automatically accept all other altcoins as well (it’s no extra work for them, and opens up new markets of customers) – Erik Voorhees

Wednesday 17th February 2016

Bitcoin Dominance Index

Bitcoin Dominance Index has fallen to 86% – Coincap.io

Wednesday 17th February 2016

Record Altcoin Trading

New record: ShapeShift just hit 20,000 orders processed in the month, with a week to go – Erik Voorhees

Saturday 13th March 2016

Bitcoin Dominance Index

Bitcoin Dominance Index falls to 76% – CoinCap

Saturday 13th March 2016

ShapeShift Volumes Surge as Demand for Ethereum Explodes

ShapeShift grew 1,000% in 2015. It has already grown another 1,000% in the first 2 months of 2016. Thank you everyone! #Bitcoin #Ethereum – Erik Voorhees

Tuesday 29th March 2016

Altcoins Plagued by Scams, Lack of Interest, Insecure Networks

To many people in the Bitcoin community, altcoins are considered nothing more than scams. Part of the reason is that altcoin developers and promoters are often found telling people to purchase an altcoin for their own financial benefit; however, this is not the case for Monero developer Riccardo Spagni.

Spagni holds a relatively pragmatic view on altcoins. The Monero developer has told individuals with limited funds to not buy the altcoin. In fact, he has stated, “The most likely scenario is that Monero fails entirely.”

Many people refer to altcoins as casinos and testnets. When asked for his opinion on this description of the altcoin market, Spagni said:

“The majority are outright scams. There’s no mincing words with this, and I think it’s absolutely disgusting. From obvious premined or instamined scams, to the more subtle mining scams that attempt to hide the premine from block explorers, there are a lot of scams meant to outrightly enrich the creators.”

In addition to the scams in the altcoin market, Spagni also sees Bitcoin clones, “corporate coins” (which are altcoins that have raised funds from investors), and a small number of coins that have something unique to offer. When it comes to those altcoins offering something useful or unique, Spagni claimed, “To fall into that last category is really hard. I’m not even sure Monero falls into it, although I do hope that it can get there.”

In Spagni’s view, the general lack of interest in altcoins and the security issues related to low-hashrate networks are the two main issues with any altcoin right now. Spagni explained:

“Seriously — any of the altcoins with an actual useful feature (like Monero, of course) are plagued by a general lack of interest, and a basically insecure hashing network. A sustained attack against Monero’s proof-of-work network would be expensive, but not expensive enough to stop a motivated attacker. Similarly, with only several hundred high capacity nodes scattered around the world, the cost of an isolation attack against end-user nodes is much lower than with Bitcoin.” – Kyle Torpey

Saturday 2nd July 2016

In May 2014 I wrote a report looking to find a few coins that were potentially useful and not scams. I couldn’t find many because of the premined, instamined problem.

Most coins follow a predictable pattern. A quick pump launched by a few preminers, big hype, big market cap, scam people to get on board. Dumped. Crash by 90% or more. Often a dead cat bounce, doubling or tripling from those 90/95% losses, then a steady fall towards zero.

Key Points

- Bitcoin’s market cap has grown from $7.3 billion to $10.5 billion, an increase of 45%

- The Monero price has increased significantly

- The Ripple price has performed surprisingly well

- Counterparty and Namecoin disappointed

Then and Now: The Big 4 Cryptocurrencies

May 27th 2014

1, Bitcoin

2, Ripple

3, Litecoin

4, Peercoin

July 1st 2016

1, Bitcoin

2, Ethereum

3, Ripple

4, Litecoin

—————–

The top 4 positions have remained quite stable. The only changes are that new entrant Ethereum has burst on the scene with a massive $1 billion market cap and Peercoin has collapsed.

Litecoin and Ripple have retained their top 4 positions. To have that kind of stability over 2 years is a good accomplishment in such a fast changing turbulent market.

Bitcoin Dominance Index:

Bitcoin Dominance Index May 2014

Bitcoin Market Cap = $7.3 billion

Altcoin Market Cap = $0.7 billion

Bitcoin Dominance Index = 91%

Bitcoin Dominance Index Today

Bitcoin Market Cap = $10.5 billion

Altcoin Market Cap = $2.2 billion

Bitcoin Dominance Index = 83%

——————————————

Altcoins as a whole have had a good run (although the majority of that $1.5 billion increase in altcoin market cap is accounted for by Ethereum and the DAO which are facing existential threats after theevents of the last few weeks).

DISQUALIFIERS FOR CURRENCY COINS

Proof of Stake

Proof of stake is a disqualifier for a currency.

Proof of Stake, is heavily flawed, not an “upgrade”. In PoS, stakeholders are censors: They may arbitrarily censor transactions (fundamental to consensus), like miners. In PoS, stakeholders are gatekeepers. You must get your stake from an existing stakeholder. Central bankers baked in. Proof of Work is more permission-less, and features greater separation of powers.

PoW has flaws, but it is not a closed system that suffers from costless simulation & other math-provable problems – Jeff Garzik

Immoral Coins: A Lack of Understanding About Economics.

Bank coins, gov coins, inflationary coins, centralized coins. Last time this ruled out Dogecoin, Freicoin, and Ripple.

Maybe some of them are not scams outright, but it’s not helpful to shift money away from bitcoin to support projects like this.

Inflationary Coins: Lack of a Sane Monetary Policy

Bitcoin has the perfect monetary policy.

It was incredibly bold for Satoshi to put the inflation rate at 0% ultimately. Inflationary altcoins are undesirable compared to bitcoin’s strict and limited issuance.

Will Altcoins Succeed Over Time?

Bitcoin’s network effect is too powerful, so probably not. It’s an uphill battle for these coins and they have many disadvantages, such as weaker security.

Improvements and extra privacy can also be built into, or on top of, bitcoin. Hopefully the privacy efforts going into bitcoin will ultimately make anonymous coins unnecessary.

Conclusion: Focus on Bitcoin, Don’t Get Distracted

Don’t let speculative experiments at the margin distract from the most mind-blowingly awesome monetary system mankind has ever seen – Bitcoin proper – Erik Voorhees

Bitcoin was a one-time thing where it had a clean launch and crept under the radar for so long. It’s amazing and deserves to be appreciated more.

The opportunity cost of not focusing on bitcoin is massive. The infrastructure is orders of magnitude more powerful than its competitors. There’s no brand recognition in the mainstream for any other digital currency. Bitcoin is way too far ahead, now is the time to accumulate and hold.

Bitcoin is a remarkable experiment. Despite having 7 years to create a better model, most competitors have failed to balance the tough problem of allocating a coin in a sustainable way. Even after 7 years, nothing comes close to bitcoin in integrity and utility.

CONCLUSION: SUGGESTED PORTFOLIO ALLOCATION

A) Digital Currency Fund

Bitcoin 99%

Monero 1%

——————-

It really is all about Bitcoin. It’s just phenomenal compared to the alternatives. The opportunity cost of investing in something else is so high.

Monero is a worthy small addition as the most advanced privacy altcoin. Also, look to add a very small amount of Litecoin (smaller than Monero) when the price is historically low.

B) Digital Assets / Platform Fund

Counterparty 100%

——————————

This fund is completely separate to the main digital currency fund (and should be much smaller). It’s incredibly speculative and is more like a stock trading account.

Altcoin Buying Opportunities

- Buy at 6 Month Lows

- Buy at 90% Fall from Previous or All-time high

- Buy When Bitcoin Dominance Index Strengthens to over 90%

– Lee Banfield, July 2016 Report: The Most Legitimate Altcoins

Thursday 18th August 2016

The Origin of “Blockchain Technology”

The Bitcoin world is full of people who know nothing about economics or cryptography; they only know that they could have made millions if they had not sold at the bottom.

These people tell themselves that they are redeemable, that Bitcoin is just the MySpace of cryptocurrencies, that they will have another opportunity to get in early on some other revolution.

I think this may explain the origin of “blockchain technology”. It lets people talk as if clones of Bitcoin are important without having to remind themselves of Bitcoin.

When people say “blockchain technology” to you, you can often replace it with “mana”, or “chakras”, or “quantum” and it makes sense the same way. “

“Blockchain technology” has evolved into a sound Bitcoiners use to extract money from venture capitalists and one another, similar to the way that male birds use a song to attract females. It’s a phrase for people who know there is a lot of money around, but don’t exactly know where it’s coming from.

People are running around everywhere in the Bitcoin world screaming “blockchain blockchain blockchain” for all kinds of non-intuitive purposes until they’re buried under piles of money. I can’t believe how long it’s taking for people to get wise to this ruse, but I hope it won’t last too much longer. – Daniel Krawisz

Wednesday 30th November 2016

- Bitcoin is once in a lifetime event. You are going to have a bad time trying to replicate its success. – Steve

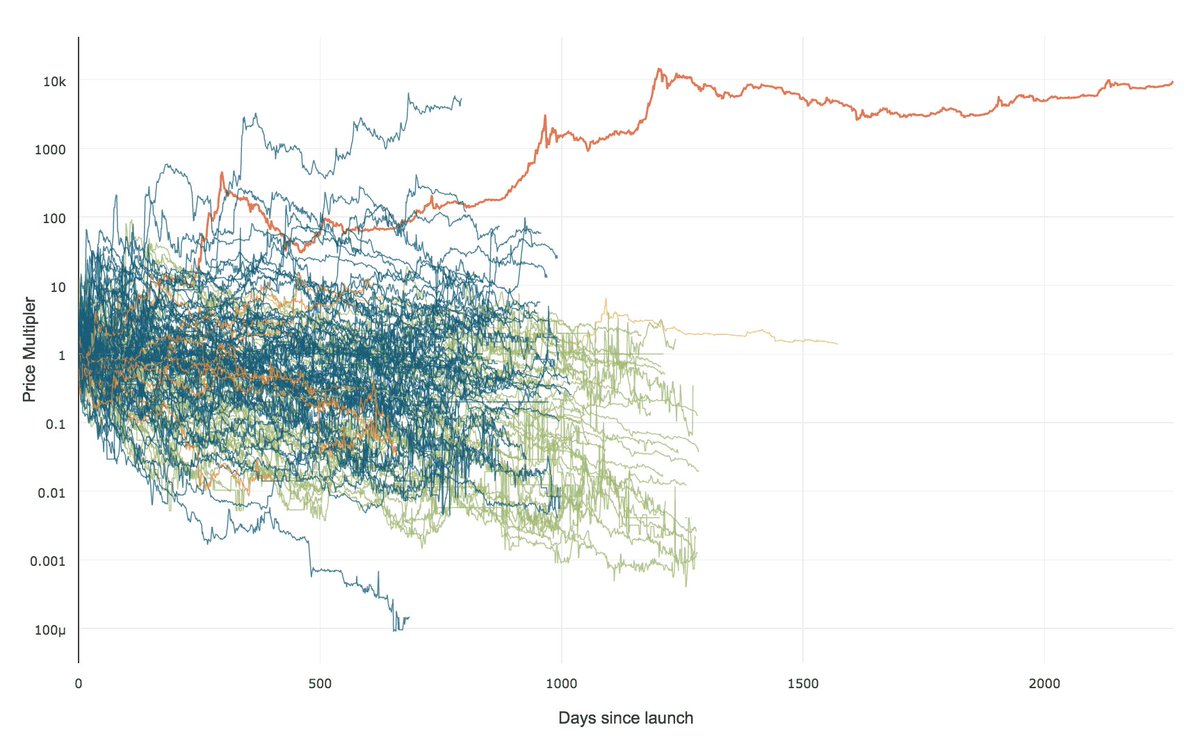

118 Altcoins Plotted vs. Bitcoin

Can you see why it’s really hard to beat bitcoin now? That red line is bitcoin, by the way.

It seems that alt-coins are best left for trading due to their volatility, but very risky as holds. Out of 700+ coins in my database I would say less than 5 have a shot of doing something interesting. – Willy Woo

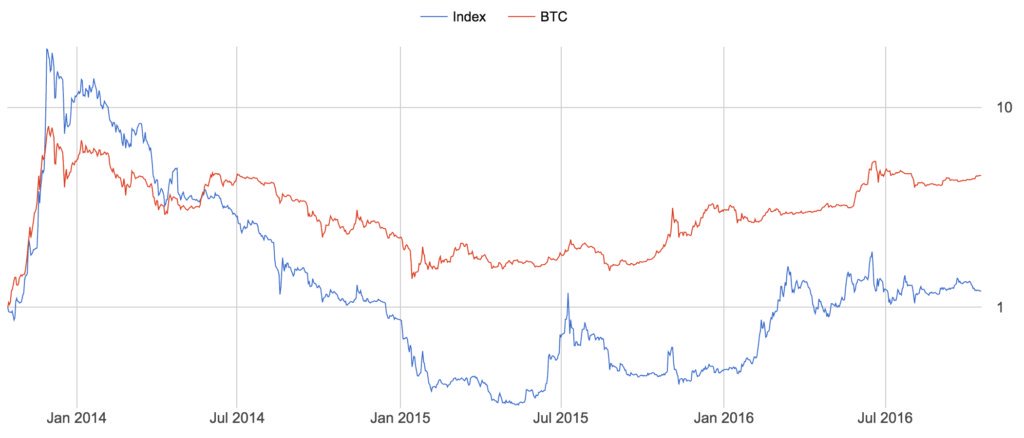

Bitcoin vs The Top 10 Ranked Altcoins

Bitcoin outperformed the alt-coin portfolio by 3.8x.

Surprisingly during the 2013 bubble, alts performed even higher, but lost more ground in the bear market thereafter.

This pattern of alts having an edge in bull markets happened twice. I make out the bottom of the market was mid-May 2015, since that time alts recovered with a 3.8x rally (from 0.308x to 1.17x), while Bitcoin recovered with a 2.7x rally (from 1.68x to 4.56x).

Bitcoin vs The 11th-20th Ranked Altcoins

To shake things up, here’s a portfolio with ten “small cap” alts ranked 11th through to 20th making up the index. The idea behind this one is to capture the coins that have more potential for growth and exiting once they graduate to the big leagues (or fade into oblivion).

These results were one of the more promising index allocations, the portfolio dropped less during the bear market and had impressive gains during bull markets, however bitcoin still won out with a 4.6x return vs 3.6x for the index which also exhibited more volatility.

Bitcoin vs. The Top 20 Altcoins

Over 3yrs, a monthly rebalanced top 20 altcoin basket returned 20% (with very high custodial risk).

Bitcoin: 360%.

Conclusion

Bitcoin is really hard to beat with altcoin index funds. Not only do they underperform Bitcoin by a significant amount, but as a combined basket their day to day volatility is higher.

There will be a bunch of altcoin funds hitting the crypto investment world in this coming year. Having seen the data, I would take the index based approaches to fund investment with a decent grain of salt. – Willy Woo

the best thing is to look for a consistent way of making money instead of being caught up in these altcoin scams.